About Me

Hi, I'm Daniel. Some call me Sangyoon. I was born in the U.S., but

spent most of my life in South Korea 🇰🇷 and Singapore 🇸🇬.

On my

Substack

✍🏼, I write about fundamental investing. Topics include

philosophies and observations, as well as my positions in crypto

venture, technology stocks, or value stocks (largely small cap

net-nets), all through the lens of concentrated value investing.

Occasionally interspersed are tidbits of my personal life.

Working in venture capital, I've been fortunate to observe

innovative businesses from the earliest stages. As a bootstrapped

founder, I've achieved a 7-figure outcome and raised venture

funding for another.

When I'm not going down rabbit-holes and writing, you can find me

playing tennis 🎾 or golf ⛳ with friends. When I'm alone, I love

playing Chopin or movie soundtracks on the piano 🎹, though I need

to start learning some new pieces again. I enjoy trying new types

of coffee ☕ (I was a Starbucks barista in my teens), and aim to

be half-vegetarian, since I'm not brave enough to go full-on just

yet.

That's a little bit about me. But if you'd like to learn more

about how I got here in the first place, come join me below.

Ever since taking a summer camp course in middle school called

"Who is Dow Jones?", I fell in love with the art of investing.

Some say investing is the last liberal art. I particularly enjoy

that it rewards independent, contrarian thinking and an even

temperament. I chose to attend NYU Stern for their undergraduate

finance program, but deferred by a year to take a value investing

course and pore through books like "The Intelligent Investor" at

the local library.

During college, I took advantage of being in NYC to intern at

three different hedge funds, grateful that such institutions would

even take a student who knew nothing like me. After graduating, I

started as an investment banking analyst. In some ways, I was

living the life - early 20s in the heart of New York, exploring

hobbies, and hosting poker games in our apartment with my two

housemates.

We also found ourselves chained to our desks on many weekends.

While banking was touted to be a good stepping stone to greater

things, I didn't see how it was making me a better investor,

particularly a long-term investor hoping to build real businesses.

It was in the midst of this environment, wondering what more there

was to life, that I discovered cryptocurrencies.

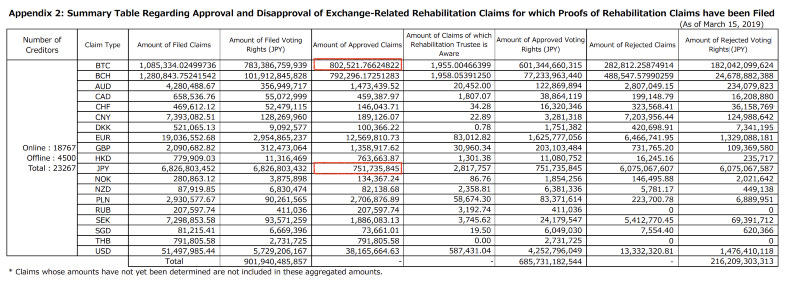

Long story short, I started arbitraging inefficient crypto

markets. This was 2017 when the market was rife with

inefficiencies.

At the time, crypto was booming. Booming so much that there

was a 30-50% spread between Korean and American crypto prices.

The opportunity was so blatant that everybody was talking

about it, yet nobody thought to actually trade it. Why? I

don't know. I asked a lot of people, and they didn't think it

was possible because of this regulation or that blocker.

With a little investigation, I sorted out the legal and trade

mechanics and was making $15,000 every single day, with just a

few clicks. This was possible because I identified the

opportunities, stayed abreast of developments, moved fast,

managed risk, and pulled all-nighters to do the grunt work

from talking to lawyers to setting up trades — all while

working a 70-80 hour / week job…

After this interesting incident, a few friends and I decided

to arbitrage the price differentials among exchanges... The

trading was run from our tiny NYC bedroom, with rotating

sleeping schedules to keep an eye on the markets 24/7. At one

point, our portfolios were worth a couple million dollars. It

was unbelievable for 23-year-olds whose bank accounts had

never seen anything remotely like it. Needless to say, it was

an exciting time. -

Medium: How I Made $15,000 / Day as a Fresh College Grad

I felt empowered - that I too could pave a path in this world

following my own beliefs, and that it was ok to be different.

I felt empowered - that I too could pave a path in this world

following my own beliefs, and that it was ok to be different.

But I wanted to do more.

The best in the space were engaged in a movement, not just

profiting off market inefficiencies. I packed up, said goodbye to

friends in New York City, my home of five years, and left my old

life behind.

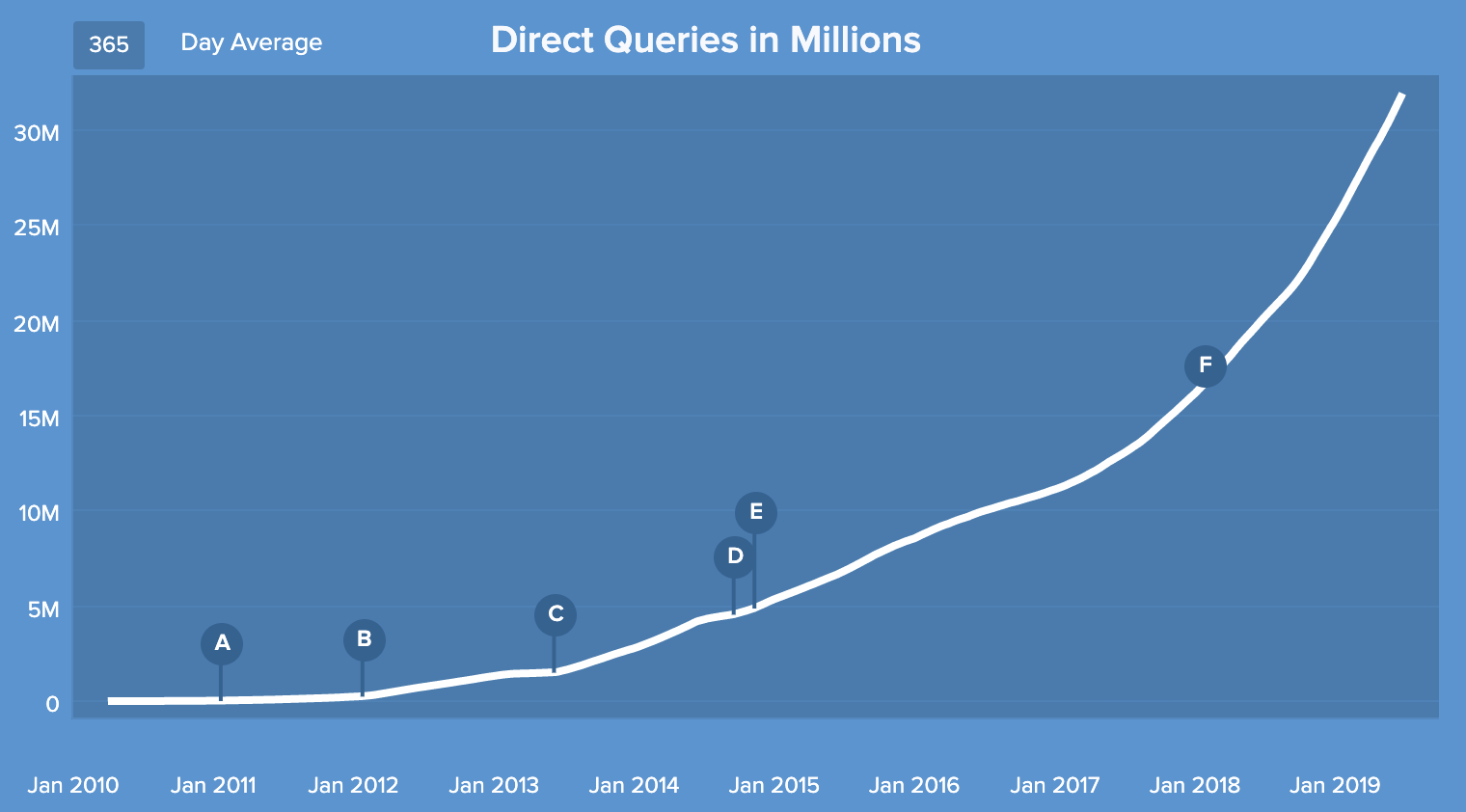

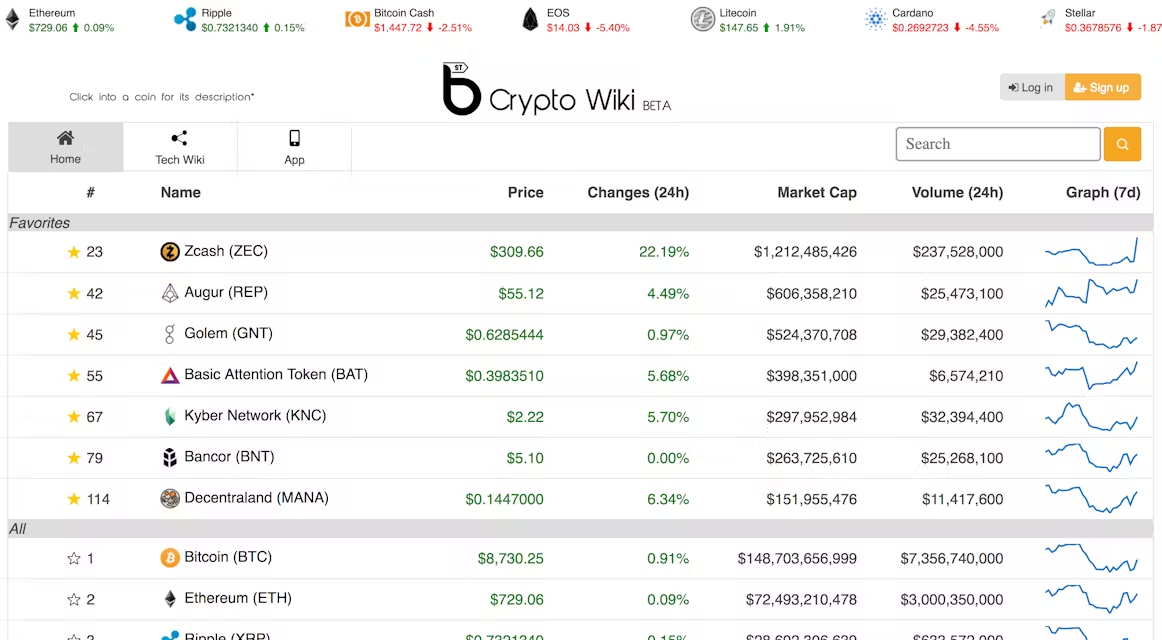

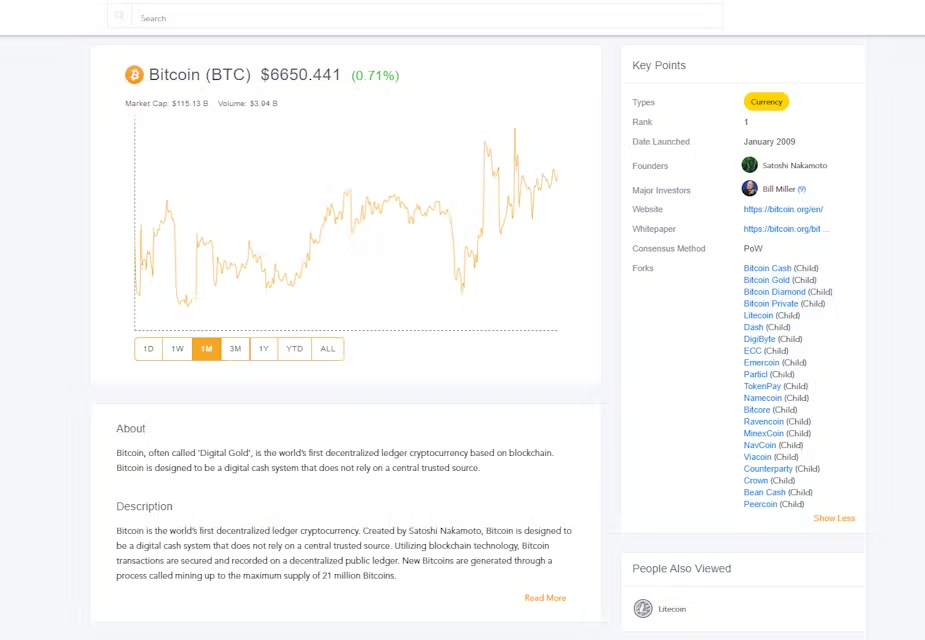

I would move to the Bay Area in 2018, at age 24, to write a book

and make a Wikipedia for crypto. Hundreds of projects with

technical jargon were popping up every day, where even someone

full-time like myself would get lost in it all. I wanted to help

people cut through the noise and understand why this technology

mattered.

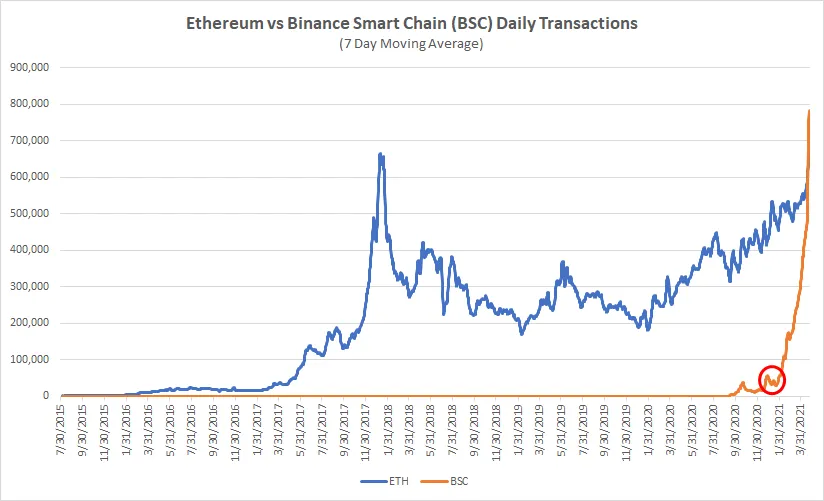

To me, crypto is an equalizing force. Imagine every time you rode

an Uber, you earned equity in the company. That's a small example

of what crypto rails make possible. On Ethereum, you can access

loans from a decentralized protocol with just an internet

connection, not gated by income, ethnicity, or social status. With

DePIN systems like Helium, I am both a consumer and owner in the

mobile network I use.

To me, crypto is an equalizing force. Imagine every time you rode

an Uber, you earned equity in the company. That's a small example

of what crypto rails make possible. On Ethereum, you can access

loans from a decentralized protocol with just an internet

connection, not gated by income, ethnicity, or social status. With

DePIN systems like Helium, I am both a consumer and owner in the

mobile network I use.

By good fortune, mutual connections put me in touch with venture

capitalist Tim Draper. I thought he was the most down to earth,

fun investor I'd ever seen, and wanted to learn everything I could

from him. For context, he was a billionaire VC and founder of

venture capital firm DFJ, and presently, Draper Associates. As it

pertains to crypto, he made news for buying the 30,000 bitcoins

from the Silk Road government auction in 2014, being one of the

first prominent figures to lend credibility to the space.

Under him, I invested early in projects like Arkham, which

increased the transparency of murky on-chain transactions, and the

investment would grow 100x within a couple years of investing. Or

Polymarket, which I saw go from an experimental project to

becoming the leading arbiter of truth, especially in the 2024 US

election. I supported them because they were both founded by

college dropouts that reminded me of my wiki-building days. We all

strived to build tools that educated and gave greater opportunity

to anyone with an internet connection.

Others, like MakerDAO, would enable more people to access loans or

lending opportunities through its decentralized protocol. And of

course, there were more established companies like Coinbase and

Ledger, whom I had the privilege to watch as an investor, the

former which would IPO at a $100 billion valuation.

Paradoxically over time, I felt simultaneously more involved and

more on the sidelines. I missed being a player on the field.

To wrap up my years of self-taught programming, I

did a coding bootcamp

(three months of living and breathing code), after which some old

friends convinced me to co-found a startup with them. One had sold

his last startup to Bitgo, and was itching to do something new.

I'd happily raise the funding, but on two conditions - that I

would work as a full-time software engineer, and be off to

business school after helping them get to the series A. Why

school? I knew I wanted to eventually work in investing where

school would be a good transition point, plus you only live once

so why not.

Luckily, I round up $3.7M in one month, after which the funding

market swiftly crashed. It was very lucky timing. I was grateful

to have entrepreneurs I respected like the founders of Youtube,

Twitch, OrangeDAO (Y-Combinator spinoff for crypto) and many

others as investors.

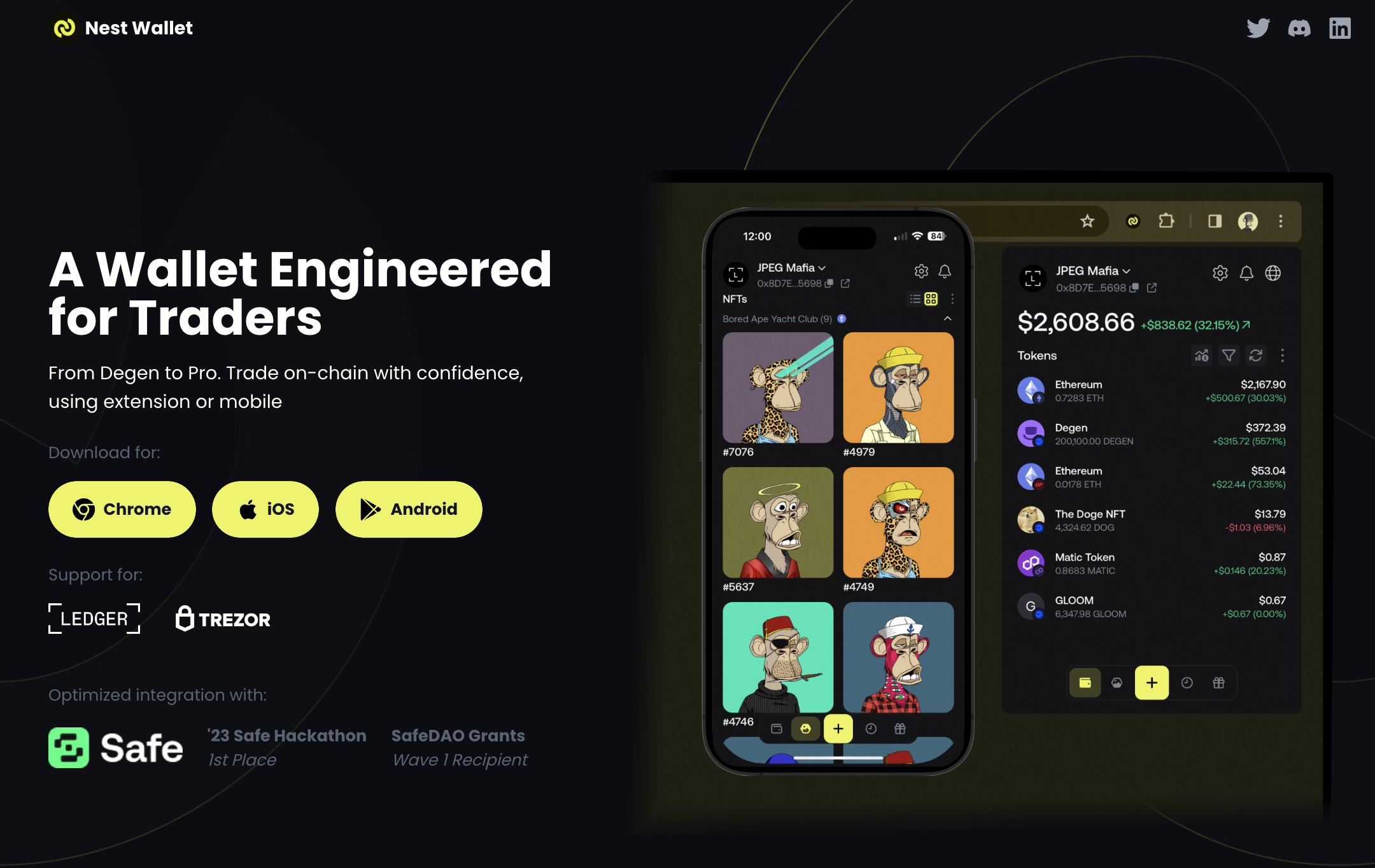

We built a prototype of a multi-signature wallet and won 1st place

in a hackathon hosted by Coinbase and Stripe. Unlike existing

multisig wallets, you could connect to any dapp through the

browser. Some companies were interested in acquiring the

technology and having us build in-house. See

Code

section for more on Nest.

My co-founder then pivoted the business into an altcoin-trading

wallet — the third sudden change in direction. Disagreeing, I

left, as did the CTO. Because the company was small yet

profitable, he sought full control and attempted to restructure

ownership, diluting us to near zero. I was able to legally block

this, but he later relaunched the company under a new name to take

entire ownership. At that point, I decided to let it go. While it

wasn’t the ending I hoped for, the experience taught me some

invaluable lessons - to evaluate partners' ethics early on, and to

avoid equal ownership structures in future ventures.

Today, I am doing my MBA at Columbia University in the Value

Investing Program - a cohort of 40 students selected to

concentrate on this field. I hope to run 1) a public value

portfolio, 2) private venture portfolio, and longer-term, 3) an

operating business, all under one roof.

The curtains are closing on my 20s, and I'm looking forward to

what my 30s will bring. I hope to have more adventurous stories

for you then. Until next time.

- Daniel Sangyoon Kim

Good old days learning from Tim. He wore a Bitcoin tie every day - a true believer.